Radiology administrators are not confident that their practices will have adequate reimbursement from Medicare in the months to come, but they remain hopeful that imaging will grow as a profit center.

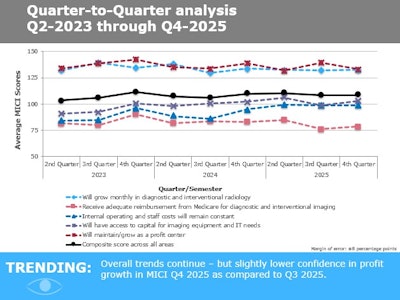

The results are from The MarkeTech Group's Medical Imaging Confidence Index (MICI) fourth quarter 2025 report, which found that administrators' confidence is "neutral and consistent" with Q3 2025, although the "downstream impact of politics continues to be a concern, with many expressing uncertainty around reimbursement, government shutdowns, and the stability of future funding," the report noted.

The MarkeTech Group produces the MICI report using survey response information contributed by radiology administrators and business managers who are members of its imagePRO panel. The survey is made up of responses to questions about trends radiology administrators face in the coming year.

This fourth-quarter report included feedback from 105 imaging directors and managers across the following U.S. geographic areas: 17% in the West North Central region, 11% in the East North Central region, 11% in the Mid-Atlantic region, 13% in the South Atlantic region, 14% in the East South Central region, 18% in the West South Central region, 12% in the Pacific region, and 4% in the Mountain region.

As for hospital/facility size, 50% of survey respondents reported 100 beds or less, 32% reported 100 to 299 beds, and 18% reported 300 beds or more.

For the survey, participants rank their confidence on five topics, and The MarkeTech Group calculates a single composite score. Scores range from 0 to 200 and can be interpreted according to the framework below:

For the fourth quarter of 2025, the report found the following:

MICI Q4 2025 confidence scores by topic | ||||

Topic | Mean score Q3 2025 | Interpretation | Mean score Q4 2025 | Interpretation |

| Will maintain/grow as a profit center | 139 | Very high confidence | 133 | Very high confidence |

| Will grow monthly in diagnostic and interventional radiology | 132 | Very high confidence | 132 | Very high confidence |

| Will have access to capital for imaging equipment and IT needs | 99 | Neutral | 103 | Neutral |

| Internal operating and staff costs will remain constant | 99 | Neutral | 99 | Neutral |

| Will have adequate reimbursement from Medicare for diagnostic and interventional imaging | 76 | Low confidence | 78 | Low confidence |

| Composite score across all areas | 108 | Neutral | 109 | Neutral |

By U.S. region, results were mixed:

Graph courtesy of The MarkeTech Group.

Graph courtesy of The MarkeTech Group.

The survey includes a free response section where administrators may comment on the five topics. Free responses included in this report mainly addressed topics for which respondents' confidence was low.

Regarding financial strain, reimbursement cuts, and political/government uncertainty, participants noted the following:

Regarding staffing shortages and operational constraints, participants wrote:

Finally, regarding volume changes, growth, and department expansion, participants noted the following:

The Medical Imaging Confidence Index (MICI) is produced by market research firm The MarkeTech Group using data from its imagePRO panel of radiology administrators and business managers.

Whether you are a professional looking for a new job or a representative of an organization who needs workforce solutions - we are here to help.